37+ Calculate my monthly mortgage payment

The monthly payment will be recalculated at the standard rate based upon the remaining balance at the time. This includes costs such as insurance or common dwelling fees before calculating the remaining capital and interest portion of your monthly payment.

10 Steps Toward Home Ownership Mortgage 1 Inc

Monthly mortgage payment Principal Interest Escrow Account.

. Interest Mortgage term Monthly payments. With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. How much income you need depends on your down payment loan terms taxes and insurance.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. Review your writers samples. Ready for a mortgage.

PMT0412 3012 200000 Where. 6 divided by 12 0005 monthly rate. My tax return this year is 500 less than last year.

When you take out a mortgage you agree to pay the principal and interest over the life of the loan. Then add the two totals to get 800 900 or 1700. Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay.

Loans that amortize such as your home mortgage or car loan require a monthly payment. By completely wiping out my 1308month mortgage payment my cash flow in their eyes increases closer to 2000month. Last years standard deduction was 127000 this year its 24000.

Given my perennial goal of making and maintaining a 200000 AGI a year this only leaves me with around 140000 after taxes 30 effective rate to live love and pay. Married filing jointly with a mortgage no kids single earner nothing has changed from prior year other than making slightly more annual raiseincrease. The capital which is the money that has been borrowed and the interest charged.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. Current 5-Year Hybrid ARM Rates. 275 words page.

Get advice on how to pay for college without drowning in debt. Mortgage Payment Predictor. As a result you need to compute the interest and principal portion of each payment on a monthly basis.

So double your property tax escrow monthly payment of 200 to get 400 and add that to the deficiency of 400 to get a total of 800. Mortgage rates starting at 5 APY. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Monthly payments on a 600000 mortgage. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total a month while a 15-year might cost a month. We are borrowing 200000 for 30 years at 4.

Scan down the interest rate column to a given interest rate such as 7. Estimate your monthly loan repayments on a 200000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

Paying Off 100000 In Mortgage Debt In A Year. You would need to subtract that and any other expenses. 12 point ArialTimes New Roman.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. Zillow has 10994 homes for sale. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total a month while a 15-year might cost a month.

Since we want the monthly payment we know we need to express the function arguments in monthly periods. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and. The higher the ratio the less likely it is that you can afford the mortgage.

Monthly payments on a 500000 mortgage by interest rate. Lets try to determine the monthly payment of a home loan. If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66.

Using The Mortgage Payment Table. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Everything you need to know about student loans.

By the time the mortgage term ends everything will usually be paid off as long as there isnt a fall behind on the monthly payments. Then follow across to the payment factor for either a 15 or 30 year term. Then double your monthly insurance escrow account payment of 100 to get 200 and add your calculated deficiency of 700 to get a total of 900.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1. For a repayment mortgage the monthly payments are made up of two parts. If you had 200 in other monthly home ownership related fees then this might take a renter equivalent of 1000 down to 800.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. To calculate your DTI add all your monthly debt payments such as credit card debt student loans alimony or child support auto loans and projected mortgage payments. Real estate 40 cities that could be poised for a housing crisis.

Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. Calculate your payments on repayment or interest only mortgages in the future by setting your outlook on our economy into this calculator. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

Total monthly mortgage payment. Which isnt horrible I see others have it way worse. So we would set up the function as follows.

Todays national mortgage rate trends. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. With each subsequent payment you pay more toward your balance.

Convert the interest rate to a monthly rate. The following table shows the rates for ARM loans which reset after the fifth year. Multiply the factor shown by the number of thousands in your mortgage amount and the result is your monthly principal and interest payment.

Year Beginning balance Monthly payment. Every month you delay benefits increases your checks slightly until you reach. With each subsequent payment you pay more toward your balance.

Rustic Ranch House In Colorado Opens To The Mountains Rustic House Ranch House Rustic Retreat

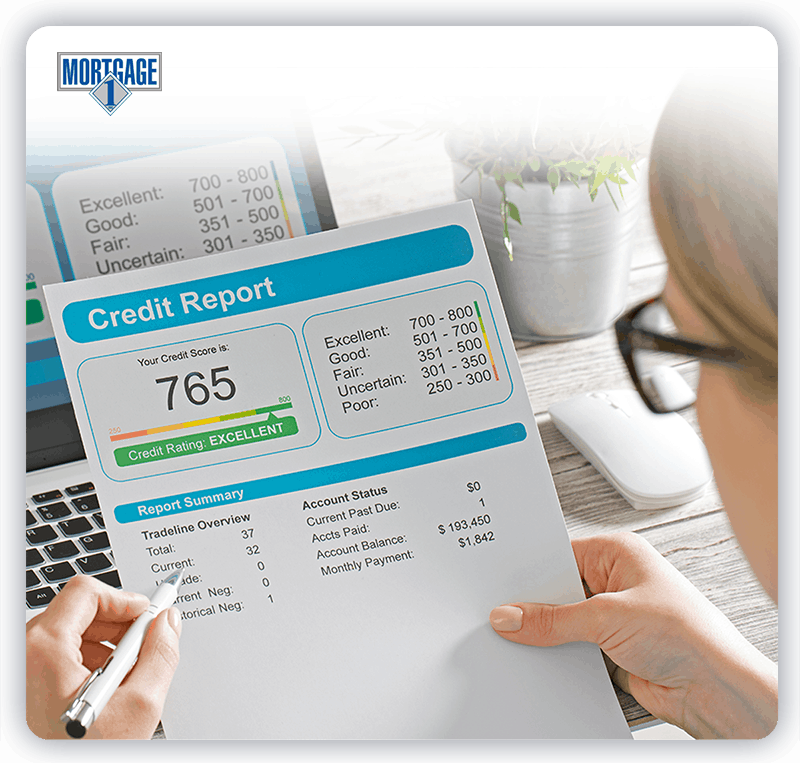

10 Steps Toward Home Ownership Mortgage 1 Inc

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

40 Stunning Price Comparison Templates Free Business Templates

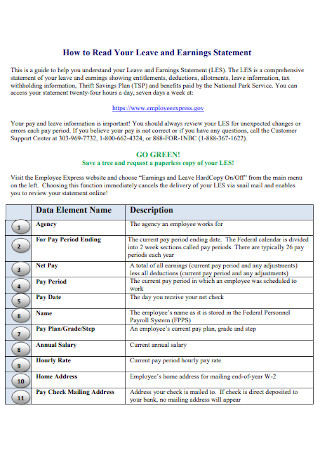

37 Sample Earnings Statement Templates In Pdf Ms Word

10 Steps Toward Home Ownership Mortgage 1 Inc

10 Steps Toward Home Ownership Mortgage 1 Inc

13 150 Catherine S Hope Eb St Croix 00820 Mls 18 845 Sea Glass Properties

10 Steps Toward Home Ownership Mortgage 1 Inc

Modern Bar Designs Google Search Glass Countertops Kitchen Remodel Kitchen Decor

40 Stunning Price Comparison Templates Free Business Templates

40 Stunning Price Comparison Templates Free Business Templates

62 Bryce Road Windsor Ny 13865 Mls 318008 Howard Hanna

How To Qualify For A Loan Tips For First Time Home Buyers

40 Stunning Price Comparison Templates Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates